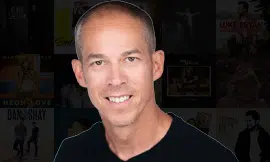

Huron-Bruce Conservative MP Ben Lobb says his bill C-234 for farmers will go to its third reading in the Senate in its original form, after proposed amendments by liberal affiliated senators were voted down.

Bill C-234 is currently before the Senate, after being passed in the House of Commons by members of parliament.

Lobb’s bill to exempt on-farm use of propane and natural gas from the carbon tax had faced potential change after amendments were proposed to scrap the farm building heating exemption from the bill and only keep the fuel use exemption for grain drying.

Lobb says the majority of senators voted Tuesday to keep the bill’s original intent, noting “The result was 42-28, which was a great result for the bill.”

He adds, “Now the bill will be debated at third reading as it was originally designed, which is great.” That debate is expected to start Thursday.

Lobb says, “I feel like the senators have listened to the farmers, they’ve listened to the farm groups and they know that they can really help them out and make a difference in someone’s business and their life.”

Lobb says the exemption of propane and natural gas would be for the heating of livestock barns, for example for pigs, chickens, laying hens, turkeys and also for buildings that grow food, like mushrooms for example.

The now defeated amendment also would have changed an eight-year sunset clause to revisit the bill to determine if the carbon tax exemption is still needed, to a three-year clause.

Lobb says the eight year clause was chosen because it allows time for green energy grain drying alternatives to be developed and make it to the market. He says, “A couple of the senators were thinking three years, well that’s just not realistic. Eight years does allow for a stretch of time to pass by and to see how it’s working and whether or not there’s new technologies that can provide a reduction in use of these fossil fuels.”

Parliamentary Budget Officer Yves Giroux shared with the senate committee, a recently (Sept 15) refined cost estimate for Bill C-234, saying, “If passed, would result in $76 million in carbon tax exemptions for farmers in 2023-24. Those exemptions would increase to $162 million in 2030-31.”

Lobb says, “It could potentially be a very historic bill in result because the Parliamentary Budget Officer identified the fact that over ten years this will put one billion dollars, over ten years, back into farmers’ bottom line. I don’t believe there’s ever been a private member’s bill that’s had that big of an impact, and at a time where we’re all suffering from the effects of inflation, this will help farmers continue to feed our country.” Lobb notes, the billion dollars takes into account the annual increase in the carbon tax.

During debate about the amendment, Senator Pat Duncan expressed the opinion that leaving natural gas and propane out of the exemption was “an oversight.”

Lobb says, “I had said many times that it had to have been an oversight, because they included in their exemption in the original carbon tax bill– they included gasoline and diesel on-farm. Which makes sense, there’s been longstanding exemptions for on-farm fuels but what was interesting at committee, the day I was there, one of the officials said they built the model, the carbon tax exemption and plan based on British Columbia’s carbon tax.”

Lobb says, “One of the senators pointed out–‘Why would you base a model for Ontario, Manitoba, Saskatchewan and Alberta that have cold winter climates on a province like British Columbia that has moderate climates and not nearly grows the same amount of grains as the other four provinces I mentioned?”

Lobb feels applying what British Columbia did, to the breadbasket of the country was a mistake.

He adds, “Really, they should take the carbon tax off for everything because it’s making it pretty tough on people. Really hard.”

Bill C-234 was part of the back and forth between Conservative Leader Pierre Poilievre and Prime Minister Justin Trudeau in Wednesday’s question period in Ottawa.

Trudeau said Wednesday, about Bill C-234, “Farmers across this country know the costs of climate change. They know the costs of extreme weather events, whether it be floods or fires or more intense storms. Farmers are worried about their future, worried about their kids’ future, worried about the country’s future. That’s why we put forward a plan that is reducing our emissions and growing our economy at the same time while putting more money in Canadians’ pockets.”